Our Capabilities

Strategic Consulting

Implementation Services

Managed Services

Staff Augmentation Services

Advisory Services

Vendor Selection and Management

At FINARCH, we have extensive experience implementing and support the leading investment management systems. Through this knowledge, we have built a comprehensive vendor software selection approach, where we will work with your organization to evaluate your Target Operating Model and which investment management systems would be best-fit to achieve your vision

Across our client engagements in vendor selection for investment managers, our approach has consistently been tailored to the specific requirements of each organization. We strike a balanced approach between standardization and customization, leveraging proven templates and accelerators while ensuring flexibility to meet unique client needs. Our ultimate objective is to maximize impact by aligning our methodology with each client’s priorities.

Vendor Selection Guiding Principles

At FINARCH, we have extensive experience leading Vendor Selection and Implementation programs for institutional investment managers in North America. Our practice brings a vendor agnostic and mature approach which is tailored to our clients unique operating strategies and company values.

Through our experience as asset management operations and implementation experts, we have developed several guiding principles as part of any vendor selection engagement and have highlighted the three key areas based on our understanding of your operations, values and objectives for this engagement.

Simplify Architecture and Reduce Technical Debt

Over-time through growth, new strategies and acquisitions, asset managers tend to acquire a technical debt of redundant and inefficient data providers and systems.

Our approach utilizes a delta-neutral principle which aims to make the most out of existing systems before considering further adoption. We use our asset management expertise to rationalize business functions within each system to ensure fit for our clients unique strategy.

Reduce Immediate and Future Data Vendor Costs

We understand that one of the largest costs for an asset manager is data, and without a data management tool or data governance framework, overpaying for data is inevitable.

As part of any vendor evaluation and system assessment, we ensure cost optimization is a key focus-area and input for any business rationalization and assessment, both for data and ongoing internal data quality, management, and governance.

Pragmatic Approach First

We understand system implementations are often challenging for asset managers, where cost over-runs and operating model re-designs occur regularly.

At FINARCH, we are implementation experts – as part of any vendor evaluation engagement, we leverage our implementation expertise to ensure that timelines and costs are pragmatic, and the engagement achieves the desired objectives

What Makes Us Different

At FINARCH our team has led, and successfully delivered, numerous large-scale implementation projects for our clients. Our primary focus is on system implementation projects, where our team typically acts as subject matter and system technical experts. We have worked with (and implemented) most of the leading systems used.

Unlike larger consultancies, our team understands the nuances for the systems used in the industry. We can provide a detailed and thorough assessment of the gaps, strengths and weaknesses relevant to our clients unique IT ecosystem – not just generic advice. From our experiences, and as a testament to many of our satisfied clients, being able to dig deeper into topics and draw on our system expertise will enable us to perform a detailed and structured analysis relevant for our clients to ensure alignment and best fit.

Our Approach

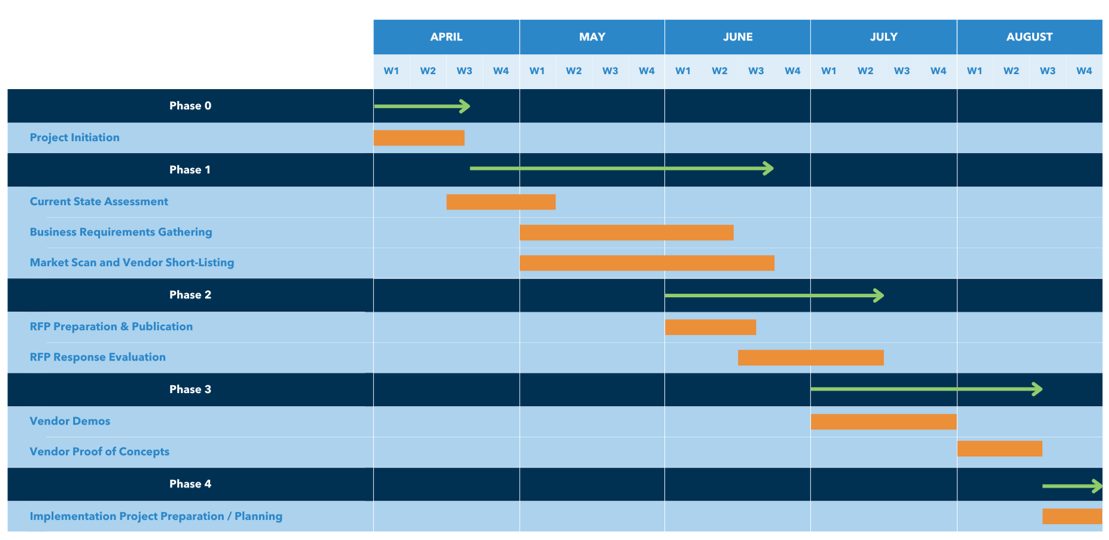

We follow a four phase approach to our vendor selection process.

- Phase Zero – Initiation: Project kickoff and align on project governance and artefacts

- Phase One – Current State Assessment: Perform current state assessment, finalize requirements, understand target state, perform market scan of landscape, and start to short-list vendors

- Phase Two – RFP: Create RFP, evaluate response and agree on finalists

- Phase Three – Demos/POC: To have short-listed vendors perform demos and proof of concepts

- Phase Four – Final Selection: Produce business case for short-listed vendors, implementation plan and final recommendation

Vendor Selection - Example Timeline

On a typical engagement, we recommend three to six months depending on the complexity. Some of the key areas which impact timeline include:

- Number of systems to be replaced and amount of technical debt assessment

- Business function (more critical functions require additional effort)

- Number of vendors to considers

Evaluation Criteria

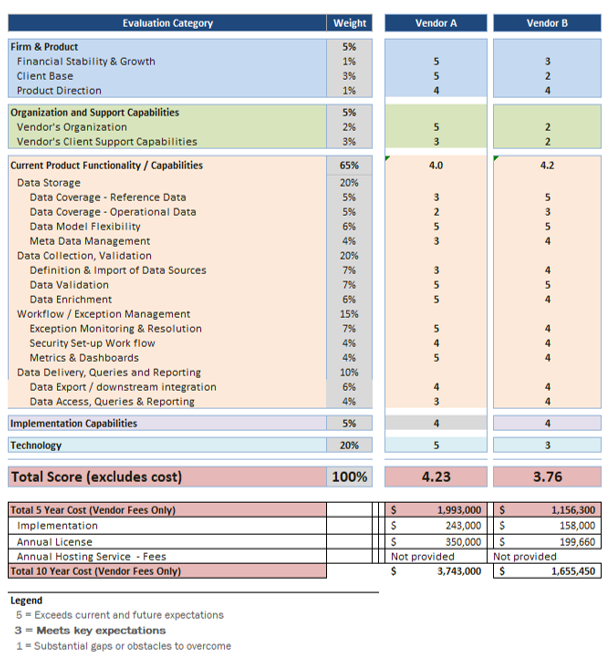

As part of the engagement, we help our clients perform extensive due diligence into the vendor evaluation process. Although each engagement is unique and tailored specifically to ours clients priorities and sensitivities.

This example is a template for an enterprise data management system selection.

Vendor Selection Scorecard – Example for EDM System

If your organization is considering a change in their IT ecosystem and wants expert guidance and advice, please reach out to our team for a complimentary session where we can share our approach in more details, testimonials, and use cases.